The Dex223 Tokenomics: Understanding the Utility and Governance of D223

As decentralized finance (DeFi) continues to revolutionize the global financial architecture, protocols such as Dex223 exemplify the forefront of innovation in blockchain ecosystems. Central to Dex223's operational and developmental framework is its native token, D223. This token serves as a foundational pillar, orchestrating utility, governance, and incentives. This discourse delves into the intricate tokenomics of D223, elucidating its pivotal role in fostering the evolution and resilience of the Dex223 ecosystem.

Utility Dimensions of D223

The D223 token transcends conventional digital asset paradigms, functioning as the operational core of the Dex223 ecosystem. Its multifaceted utility is delineated as follows:

1. Facilitation of Transaction Fees

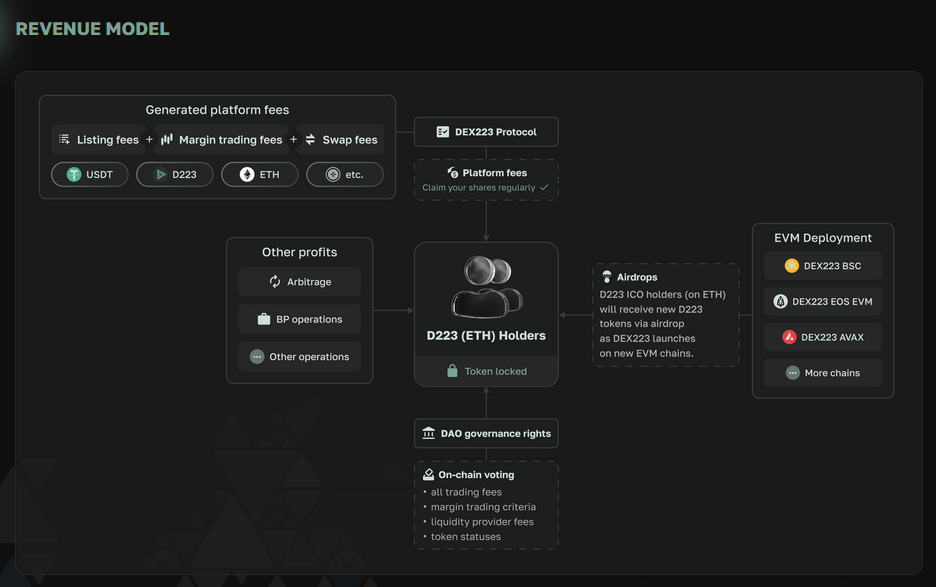

Within the Dex223 framework, D223 serves as the principal medium for transaction fee settlements. Token holders are incentivized through fee discounts, thereby enhancing the token’s utility and encouraging its circulation across the platform’s trading activities.

2. Mechanisms for Staking and Liquidity Provision

D223’s integration into staking and liquidity protocols constitutes a cornerstone of its utility. Participants who stake D223 receive rewards, while liquidity providers who contribute to Dex223’s pools accrue compensation in trading fees and supplementary D223 tokens. This dual mechanism fosters market depth, stability, and optimal transactional fluidity.

3. Access to Exclusive Features

Possession of D223 confers privileged access to premium functionalities within the Dex223 ecosystem. Such features may include advanced analytics, preferential participation in token launches, or reduced fees for select DeFi services, thereby reinforcing the token’s intrinsic value.

Governance: Decentralized Consensus Mechanisms

Beyond its functional utility, D223 is instrumental in decentralizing decision-making processes within the Dex223 ecosystem. Governance mechanisms empower token holders to collaboratively shape the platform’s trajectory, operationalized through:

1. Proposal Submission and Refinement

Community-driven proposals for protocol enhancements, fee adjustments, or feature integrations are integral to the governance process. These proposals undergo communal scrutiny and refinement prior to being subjected to voting.

2. Voting Dynamics and Influence

D223 tokens confer proportional voting rights, with the magnitude of influence correlating to the number of tokens held. This structure incentivizes active participation by stakeholders committed to the platform’s success.

3. Strategic Allocation of Treasury Resources

Token holders collectively oversee the distribution of Dex223’s treasury assets, ensuring that funds are judiciously allocated towards developmental initiatives, strategic partnerships, and community-driven incentives.

Participation Incentives and Ecosystem Development

The tokenomics framework of D223 is meticulously crafted to reward user engagement and foster enduring commitment. Key mechanisms include:

1. Yield Farming Incentives

Participants engaging in yield farming through Dex223’s liquidity pools earn D223 tokens as rewards. This approach not only enhances user engagement but also augments liquidity within the ecosystem, bolstering its functional robustness.

2. Deflationary Tokenomics via Burn Mechanisms

To preserve scarcity and support long-term value appreciation, a fraction of the transaction fees denominated in D223 is systematically burned. This deflationary mechanism aligns the token’s economic model with sustainable growth objectives.

3. Catalyzing Innovation through Developer Grants

Acknowledging the imperative of technological advancement, the Dex223 platform allocates D223 tokens to developers and innovators contributing to the ecosystem. These grants incentivize the creation of tools, applications, and integrations that expand the platform’s capabilities and adaptability.

Conclusion

The tokenomics of D223 epitomize a sophisticated synthesis of utility, governance, and incentives, offering a paradigmatic model for sustainable and decentralized ecosystem development. By seamlessly integrating these dimensions, Dex223 not only cultivates a dynamic, user-centric platform but also establishes a blueprint for innovation in the DeFi landscape.

For investors, developers, and blockchain aficionados, a nuanced understanding of D223’s tokenomics unveils the intricate mechanisms underpinning its efficacy and potential. As Dex223 evolves within the rapidly shifting terrain of decentralized finance, the D223 token will invariably remain a pivotal force, steering the ecosystem’s trajectory towards a decentralized and equitable financial future.

- - -

This article was written with the assistance of AI to gather information from multiple reputable sources. This article is for informational purposes only and does not constitute financial advice. Investing involves risk, and you should consult a qualified financial advisor before making any investment decisions. Original reporting sources are credited whenever appropriate and as required.