Commentary on the DEX223 Development Report for August-September

This article is a commentary on the published report, with additional context from the author. The report describes the current development status of the margin trading module and supporting modules, such as the creation of ERC-223 and on-ramp tokens.

A periodic report on the development of Dex223 for August–September has been published. Dex223 is promoting the ERC-223 standard to the masses. As always, let’s briefly review the work done over the past two months, as well as look at some of the pitfalls that exist in the development of DeFi applications, which developers usually do not talk about, but everyone encounters in one way or another — for example, the integration of USDT, which we discussed in the April–May report.

User ERC-223 Tokens

After the release of the alpha version of Dex223, which includes exchange and liquidity pool creation, users began creating and adding ERC-223 standard tokens to liquidity. However, this led to token identification collisions with the exchange’s contracts. Regardless of whether you open the description of the ERC-223 or ERC-20 standard on GitHub or the official Ethereum resources, it’s always a minimalistic description of the ERC itself without auxiliary modules or functions. That’s why constructor frameworks like OpenZeppelin are so popular. Public blockchains and the distribution of smart contracts as open-source software have partly lowered the entry barrier for regular users into application development. But the nuances that must be considered are often tricky and invisible to non-professionals.

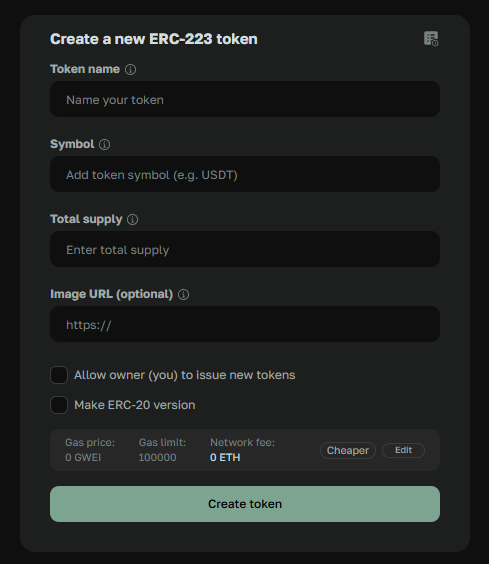

To make it easier for users who want to launch their own ERC-223 standard tokens, the developers created an ERC-223 token creation tool.

To prevent a collision related to the absence of an ERC-20 version of deployed ERC-223 tokens, users can select the option “Make ERC-20 version” An ERC-20 wrapper will also be automatically deployed when creating a pool with a new ERC-223 token.

As discussed in previous articles, the reference ERC-223 standard does not have the transferFrom() function, which allows a third party to spend funds. Therefore, existing DeFi protocols cannot work with tokens without this function, and sending tokens by other methods simply won’t register them in DEX contracts. In fact, Dex223 can handle exchanges without transferFrom(), but the current NonfungiblePositionManager cannot process liquidity addition, which is why D223 and ERC-223 tokens obtained through the converter are backward compatible. Tokens created through the “Create a new ERC-223 token” page will also have a backward-compatible approve & transferFrom pattern.

Figma template with interface update and ERC-223 token creation page.

Token Listing System

Automatic listing simplification — now it’s not necessary to add a token to a liquidity pool to include it in the automatic token list.

Margin Trading Module

The margin trading module has been tested. The tests revealed an issue in the script execution when a trader accumulates a funding rate on borrowed funds and fails to repay it on time, while their margin also doesn’t cover this rate. The script was refined to fix the liquidation scenario and retested. Now the team plans to conduct a stress test for cascading liquidation scenarios.

Those who run their own liquidation scripts should also pay attention to this issue.

Note: Since there is no official information about the launch of the margin trading module into production, users should exercise caution on the Ethereum mainnet.

Figma template with redesigned margin module UI.

Bug Bounty

The Bug Bounty program is still active and has already produced results. Participant @nathanogaga118 found a vulnerability in the third-party Wallet Connect module and was paid a reward.

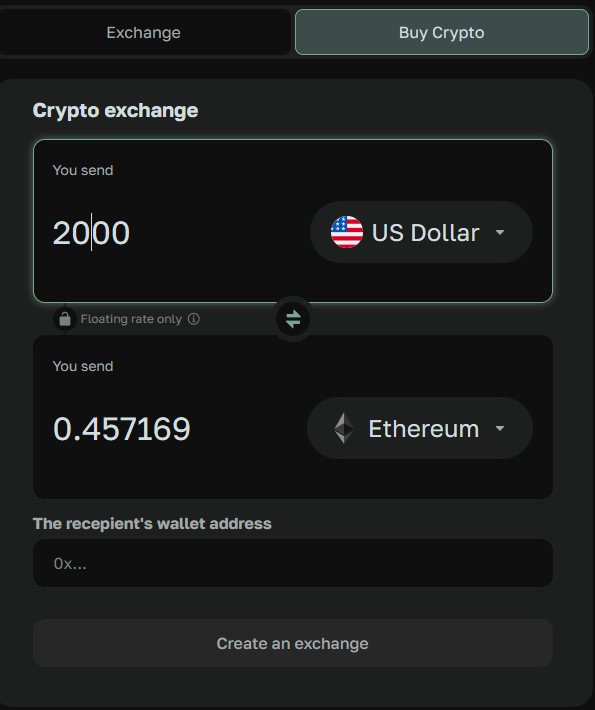

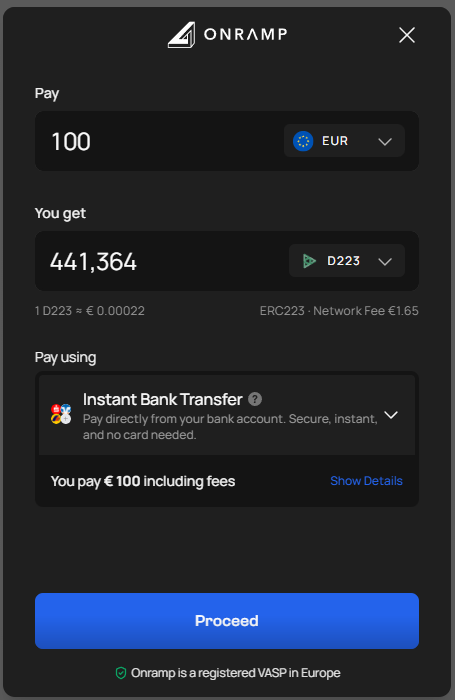

Fiat OnRamp

The Fiat OnRamp mechanism from the third-party providers OnRamp Money and SimpleSwap has been added to the Dex223 test interface. It should be noted that any legal fiat mechanisms in the industry generally require some form of user verification and come with certain limitations. It should also be understood that the transaction takes place through the OnRamp service provider’s platform, and any price discrepancies or additional fees are not related to Dex223 itself.

SimpleSwap

OnRamp Money

D223 Yield Staking

The yield staking feature for D223 holders is under development. The contract is ready, but the interface is still being developed. A withdrawal delay has been introduced for staked funds, which is a standard condition for most staking services across various assets. In general, it’s worth waiting until the income module development is completed to learn all the conditions, which usually exist to ensure fair distribution and prevent manipulation.

Developers’ Multisig

The team has deployed a multisignature wallet contract on Ethereum to store the developers’ D223 tokens. The code is verified, and all contract parameters can be viewed. A logical step toward developer transparency before the community.

Figma templates of the Multisig user interface.

Airdrops on Other Networks

The first network chosen for live testing is ApeChain. The report mentions that the developers will take a snapshot, and D223 holders on Ethereum will receive an airdrop of tokens on the ApeChain network. A roadmap for Dex223’s expansion into other networks will follow. It’s worth waiting for more detailed information, as initially, active D223 stakers are expected to be the airdrop participants.

Figma template of the Airdrop interface.

Conclusion

The August–September report turned out to be quite short, and that’s a good thing — it means the developers are encountering fewer and fewer hidden pitfalls in their work. The margin module’s progress toward the final testing stage frees up resources for completing the final stretch — the D223 yield module and airdrops. During this period, we may also see some revival in D223’s price dynamics (not financial advice).

As always, we wish the developers good luck.

Note: This analysis is entirely the author's vision. It is not a call to action or investment advice.This article is for informational purposes only and does not constitute financial advice. Investing involves risk, and you should consult a qualified financial advisor before making any investment decisions. Original reporting sources are credited whenever appropriate and as required.