Dex223's Roadmap Decoded: A Vision for the Future of Decentralized Finance

The decentralized finance (DeFi) sector, marked by rapid innovation and transformative potential, demands platforms that push the boundaries of technological and financial integration. Dex223, an emerging leader in this ecosystem, has articulated a forward-thinking roadmap aimed at addressing critical challenges and expanding the scope of decentralized exchanges (DEXs). This article deconstructs Dex223's roadmap, shedding light on its proposed features and their potential implications for the broader DeFi landscape.

Advancing Interoperability: The Promise of Cross-Chain Swaps

Among the most transformative developments outlined in Dex223’s roadmap is the introduction of cross-chain swap functionality. This feature will facilitate the direct exchange of tokens across disparate blockchain networks without requiring centralized intermediaries. By enabling seamless interactions between ecosystems such as Ethereum, Binance Smart Chain, and others, Dex223 seeks to dismantle the fragmentation that has historically hindered DeFi’s growth.

The ramifications of this innovation extend far beyond convenience. Enhanced interoperability will provide users with greater liquidity options and flexibility while empowering developers to create cross-chain applications. As interoperability becomes a cornerstone of DeFi’s evolution, Dex223’s emphasis on bridging blockchain ecosystems positions it as a pivotal player in this transformative movement.

Integrating Traditional Finance: Tokenized Stocks on the Blockchain

Dex223’s roadmap further distinguishes itself through the planned integration of traditional stock assets into its decentralized platform. By tokenizing equities such as Apple, Tesla, and other blue-chip stocks, the platform aims to offer users a unified venue for trading both cryptocurrencies and traditional financial instruments.

This initiative represents a significant step in blurring the boundaries between conventional finance and DeFi. Tokenized stocks democratize access to equities by enabling fractional ownership, extending trading hours to a 24/7 cycle, and providing global accessibility. Such innovations have the potential to attract a new demographic of investors, ranging from traditional market participants intrigued by blockchain’s possibilities to crypto-native users seeking diversification. This convergence could catalyze unprecedented growth for Dex223 and the broader DeFi ecosystem.

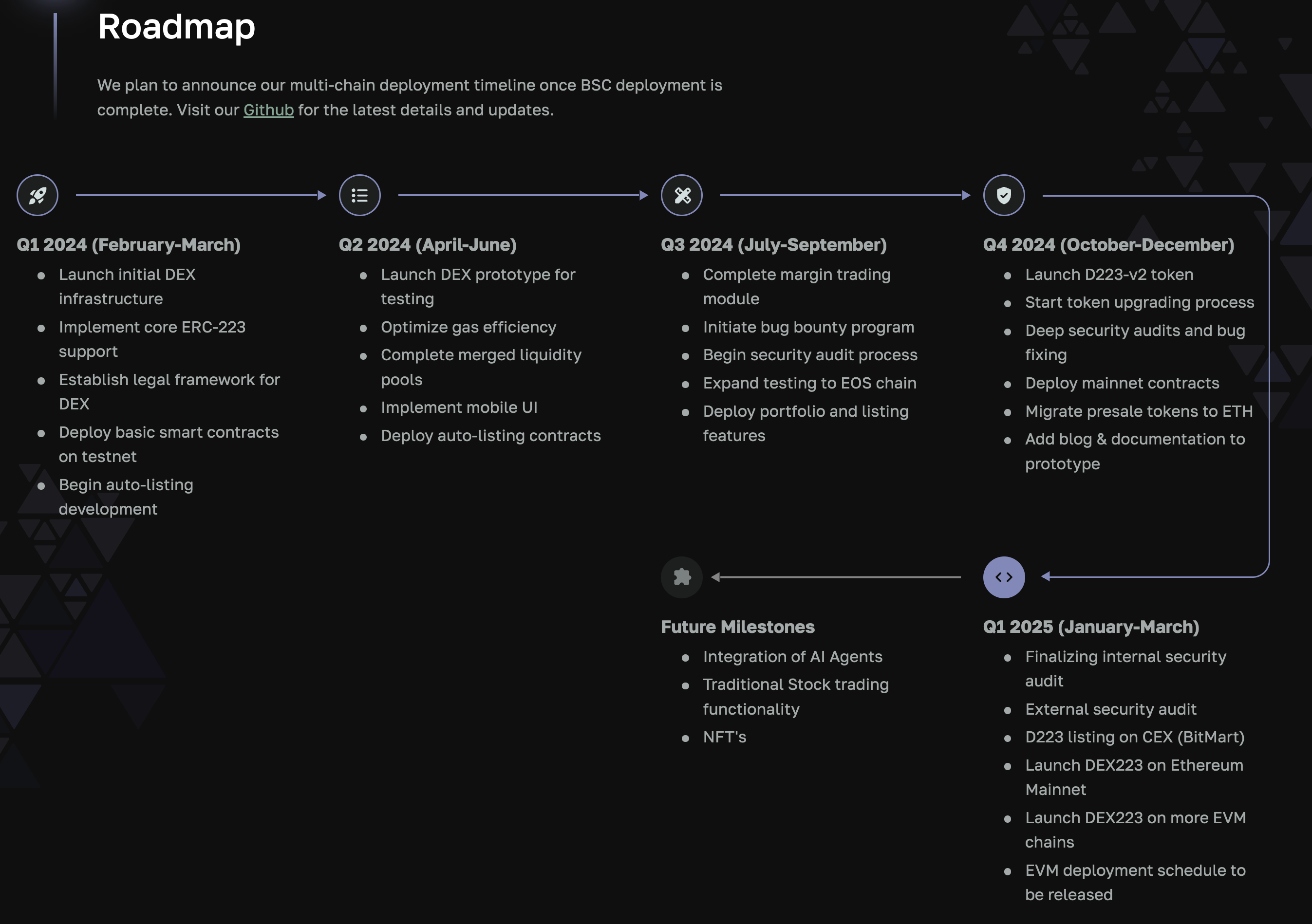

Source: Dex223.io

Harnessing Artificial Intelligence: Revolutionizing Portfolio and Wallet Management

In a bid to enhance user experience and financial decision-making, Dex223 plans to integrate artificial intelligence (AI) into its platform, particularly in portfolio and wallet management. By leveraging machine learning algorithms, the platform will analyze historical data, market dynamics, and individual user behaviors to deliver personalized investment insights.

For instance, an AI-driven assistant might recommend portfolio rebalancing to mitigate risks during periods of heightened market volatility or highlight emerging opportunities aligned with a user’s investment goals. This confluence of AI and DeFi stands to democratize access to sophisticated financial tools, empowering users regardless of their expertise level and making decentralized finance more accessible and efficient.

AI-Driven Market Analysis and Automated Trading

Building on its AI-driven innovations, Dex223’s roadmap also emphasizes the deployment of advanced machine learning models for real-time market analysis and automated trade execution. These capabilities aim to provide users with a competitive edge in navigating the complexities of DeFi markets.

By automating tasks such as market monitoring, trend prediction, and trade optimization, AI systems can mitigate human biases and emotional decision-making. The integration of such technology promises not only enhanced efficiency but also increased profitability for users. Dex223’s focus on AI underscores its commitment to staying at the forefront of technological advancements within the DeFi sector.

Strategic Considerations: Balancing Innovation with Responsibility

Dex223’s ambitious roadmap is more than an aspirational blueprint; it reflects a calculated strategy to address key industry challenges. Cross-chain swaps respond to the pressing need for interoperability, while tokenized stocks unlock untapped pools of traditional investors. Concurrently, AI-driven features enhance usability and efficiency, making DeFi more accessible and equitable.

However, such innovations necessitate a robust commitment to security, compliance, and transparency. For instance, cross-chain swaps must incorporate rigorous mechanisms to safeguard against vulnerabilities. Tokenized stocks require adherence to legal and regulatory frameworks to ensure legitimacy and inspire user trust. Similarly, AI models must prioritize fairness, accountability, and explainability to maintain confidence in their recommendations and decisions.

Charting the Path Forward

Dex223’s roadmap represents a bold vision for the future of decentralized finance, combining cutting-edge technology with a user-centric approach. By addressing fundamental barriers to adoption and expanding the utility of DEXs, the platform is poised to redefine what is possible in the DeFi space.

As these features come to fruition, Dex223 has the potential to serve as a cornerstone for a more interconnected, accessible, and innovative financial ecosystem. With its focus on interoperability, traditional finance integration, and AI-driven solutions, the platform is not merely reacting to trends but actively shaping the future of decentralized finance. The journey ahead is one to watch, as Dex223 continues to challenge the status quo and set new standards for the industry.

- - -

This article was written with the assistance of AI to gather information from multiple reputable sources. This article is for informational purposes only and does not constitute financial advice. Investing involves risk, and you should consult a qualified financial advisor before making any investment decisions. Original reporting sources are credited whenever appropriate and as required.